Small Benefit Scheme – FAQs

From working with hundreds of Irish companies over the past 15 years to provide tax-free rewards under the Small Benefit Scheme, here are the most common questions we get asked by companies-

Q. What is the legislation behind the Small Benefit Scheme?

A. Section 112B of the Taxes Consolidation Act 1997 is the statutory instrument that underpins the Scheme.

Q. Can we use the Small Benefit Scheme to pay bonuses?

A. The key here is understanding if the KPI bonus is part of your contractual remuneration (ie specified in your employment contract), or if it is discretionary (ie up to the company to decide if and how much to pay).

Discretionary bonuses qualify for the Small Benefit Scheme, contractual remuneration does not. Also, only a maximum of 2 tax-free bonus rewards can be given in any one year (up to €1,000 combined).

Q. If an employment contract includes quarterly bonuses if KPIs are met, can the first bonus be paid via a tax free reward?

A. The key here is understanding if the KPI bonus is part of your contractual remuneration (ie specified in your employment contract), or if it is discretionary (ie up to the company to decide if and how much to pay). Discretionary bonuses qualify for the Small Benefit Scheme, contractual remuneration does not.

Q. What happens if I want to give an employee a single reward that is over €1,000?

A. Then, the entire reward is subject to BIK. For example, you award an employee a gift voucher worth €1,250 in December. It is the first award/gift the employee has received that year. Because the benefit exceeds €1,000 in value, the full value of that benefit is subject to PAYE, PRSI and the USC.

In this case, the best solution would be to award €1,000 in tax-free gift vouchers to the employee and process an additional bonus payment of €250 in the employee’s payroll in December. The company can decide whether the employee should pay the tax on the €250 or whether to gross-up the payment and pay the tax on it for the employee.

Q. Can company directors avail of the Small Benefit Scheme?

A. In understanding whether a company director qualifies for the Scheme, the key factor is whether the director is considered an employee, as the legislation behind the Scheme states that the voucher must be “given to an employee by his or her employer“. Therefore the following commonly applies –

- Proprietary Director – qualifies for the Scheme as long as they are in paid employment in the company. As proprietary directors are classified as self-employed for PRSI, and there is no employer PRSI for self-employed workers, the overall tax-saving may be 11.05% less than for non-proprietary directors.

- Salaried Director – qualifies for the Scheme as they clearly satisfy the employer / employee relationship requirement.

- Director who receives Directors’ Fees – qualifies for the Scheme as long as the directors fees are paid via payroll (which is the method Revenue recommends).

- Non-Exec Director who receives Dividend Income – though not specifically excluded from the Scheme, these directors may not satisfy the employer / employee relationship requirement. Companies should seek their own specific tax-advice on this.

- Unpaid Directors – normally do not qualify for the Scheme as they are not employed by the company. In some cases, employed directors can forego salary while still being considered employed. Companies should seek their own specific tax-advice on this.

Q. Can self-employed workers avail of the Scheme?

A. Yes, as long as they are in receipt of “Schedule E” income from their company on which income tax, PRSI and USC is being deducted. As there is no employer PRSI for self-employed workers, the overall tax-saving may be 11.05% less than for employed workers.

Q. Can Sole Traders avail of the Small Benefit Scheme?

A. No, because Sole Traders do not receive Schedule E income from their businesses. Employees of Sole Traders can avail of the Scheme however.

Q. Do contractors qualify for the Small Benefit Scheme?

A. Yes. How they qualify just depends on how they get paid. If an external contractor is paid through your company’s payroll, then they can avail of the Scheme through you. If they invoice for their services, they can avail of the scheme as an employee of their own company. They cannot qualify both ways.

Q. If I have 2 sources of income from 2 separate companies, can I receive tax-free vouchers from both?

A. This one is unclear. The legislation says that not more than two vouchers totaling €1,000 can be given to an employee in a year, but doesn’t say if that is from one or multiple employers. Employees should seek their own specific tax-advice on this.

Q. Do part-time employees qualify for the full €1,000 relief on the Scheme?

A. Yes, they do. No distinction is made by Revenue between full and part-time employees. As long as the person is an employee of the company, they can avail of the full €1,000 threshold regardless of the number of hours they work.

Q. Is there a minimum the employee needs to earn to qualify?

A. No, the person just needs to be an employee at the time the reward is made.

Q. Is there a minimum employment period to qualify?

A. No, the person just needs to be an employee at the time the reward is made.

Q. Can we use the scheme for our Northern Ireland employees?

A. No, not unless they are being paid through the ROI payroll, and are paying income tax to Irish Revenue.

Q. If not fully used up, can the €1,000 tax-free amount be carried over to next year?

A. No. On January 1st each year, the €1,000 is reset for every employee, regardless of how much or how little they were awarded through the scheme in the previous year.

Q. How is the €1,000 accounted for on the employees pay slip?

A. The tax-free reward does not get included in the company payroll or employee payslip.

Q. What happens if I want to give employee rewards more than twice a year?

A. Only the first two rewards will qualify for the Small Benefit Scheme.

For example, you award a €500 voucher in January to an employee, and then another €500 to the same employee in July. Both of their rewards are tax-free under the Scheme. However, if an employer gives a further €100 reward in December, the employer would need to pay the BIK on this voucher by grossing up the €100 benefit in the employee’s payslip, and paying the taxes for them.

Q. As an employer, do I need to make a return to Revenue for the Small Benefit Scheme?

A. No. If audited, it is sufficient to show that the total cost of the Small Benefit Scheme is the same or less than the no. of employees at the time multiplied by €1,000. More detailed records can obviously be kept if desired.

Q. As an employee, do I need to make a return to Revenue for the Small Benefit Scheme?

A. No, nothing needs to be returned to Revenue.

Q. Is there any way to use the Small Benefit Scheme year round?

A. Yes! You can use the scheme throughout the year in conjunction with a qualifying points system, such as Allgo Points.

With this Revenue-approved system, you can award points to your employees throughout the year, and then have the points converted into gift cards at the end of the year up to maximum of €1,000 tax-free.

Q. Can the Small Benefit Scheme be used for Industrial Relations?

A. Not only can it, but more and more labour agreements are incorporating a mandatory tax-free payment to workers through the Scheme.

Q. How much do Irish companies typically award on average through the Scheme?

A. The average reward per employee was just over €300 in 2021 when the Scheme was limited to €500 per employee.

The average reward per year on the Scheme is expected to increase with the new threshold of €1,000 in 2022.

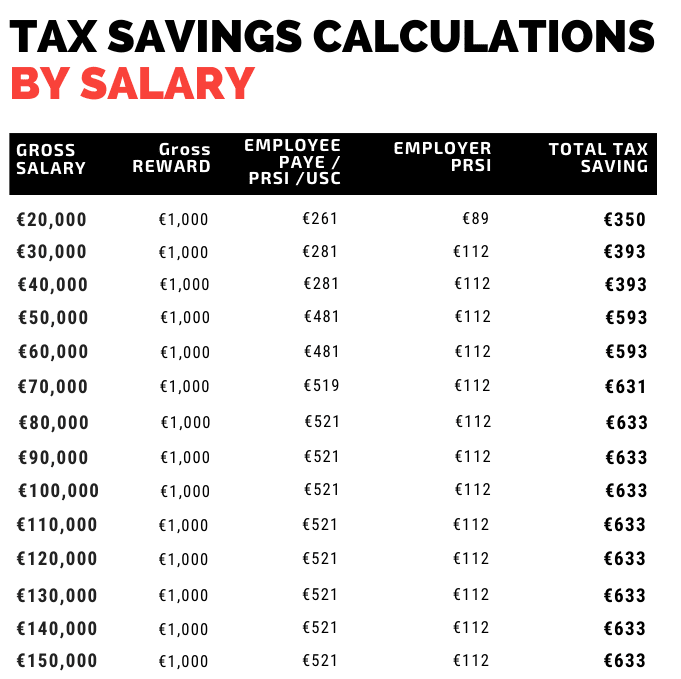

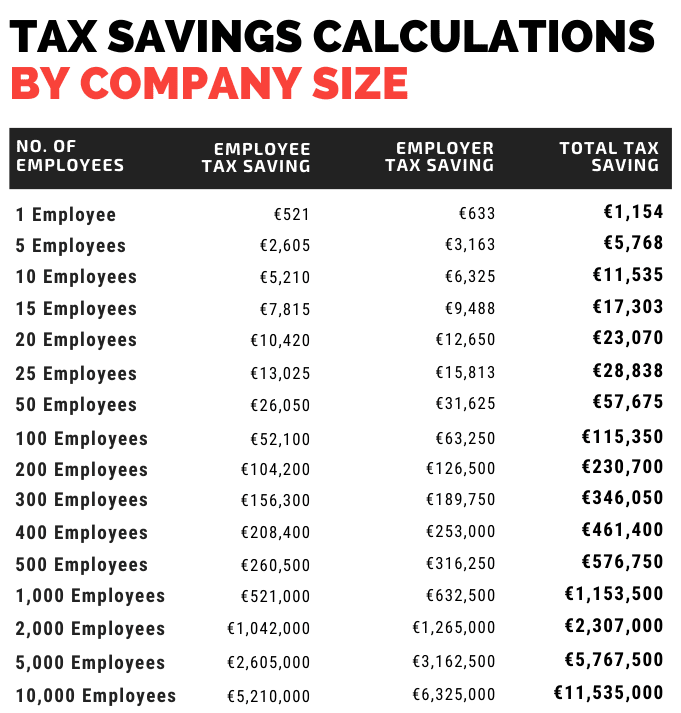

Q. How much tax do Irish employers save each year?

A. If all Irish employers fully availed of the Small Benefit Scheme at the higher rate of tax, the total annual tax saving would be €1.3 billion!. Because only 60% of Irish employers use the Scheme, and on average those that do are expected to avail of about 60% of the €1,000 limit, the actual annual tax saving is in the region of €400 million.

Q. What are the best reward options for Small Benefit Scheme?

A. The most popular rewards on the Scheme are multi- retailer gift cards (like One4All, Me2You and AllGifts Vouchers), Supermarket gift cards (like Dunnes or Tesco), and open-loop Mastercard gift cards (like the Allgo Mastercard that can be spent anywhere that accepts Mastercard). Other options include local shopping vouchers and physical gifts (eg seasonal hampers).

Q. If we give Long Service awards, can the employee still use the Scheme?

A. Yes, as long as in relation to the long service award-

- the award is made to mark long service of not less than 20 years.

- the award is a tangible item (that is, not vouchers, bonds or cash)

- the cost is not more than €50 for each year of service.

- no similar long service award has been made to the employee within the previous five years.

Q. If we offer staff a discount on our own goods and services, can we still use the Scheme?

A. Yes, as long as in relation to the discounted goods or services-

- the amount paid by the employee is equal to or more than the cost to the company, and

- the discounted goods cannot easily be changed into money.

If your question on the Small Benefit Scheme is not answered here, don’t hesitate to contact Allgo Rewards for further discussion.