Allgo Mastercard – Client Terms & Conditions

Allgo Mastercard Services Agreement – V3.3 | 15.11.2023

1 DEFINITIONS AND INTERPRETATIONS

Unless the context otherwise requires, the following terms shall have the following meanings:

“Allgo Rewards (“Allgo”) means Allgo Global Rewards Limited, the distributor of the Allgo Mastercard Gift Card under agreement from the Card Issuer, and pursuant to licence by Mastercard International Inc.

“Allgo Mastercard Gift Card” (“Gift Card” or “Card”) means the prepaid Mastercard gift card provided by Allgo Global Rewards Limited and issued by the Card Issuer, which comes in 3 different formats as detailed in Schedule A – Physical Gift Card, Schedule B – Digital+ Gift Card, and Schedule C – Online Only Gift Card.

“Agreement” means these terms & Conditions that the Client and Allgo agrees to in relation to the Services;

“Card Activation” is the process by which the Cardholder registers their card in an online account accessed via allgogiftcard.com AND unlocks their card by entering the same last name for their Card as contained in the Order Spreadsheet.

“Card Funds” means the funds provided by the Client for loading onto Gift Cards as part of an Order;

“Card Issuer” means EML Money DAC, 2nd Floor, La Vallee House, Upper Dargle Road, Bray, Co. Wicklow, Ireland, as issuer of the Allgo Mastercard Gift Card as authorised by the Central Bank of Ireland under the Electronic Money Regulations 2011 (register Ref: C95957);

“Cardholder” means any employee of the Client who receives a Gift Card as part of an Order, or any other recipient that the Client gives a Card to;

“Cardholder Terms & Conditions” means the rules & regulations, conditions, policies and charges that apply to Cardholders as detailed in Schedule E – Cardholder Terms & Conditions;

“Client” means the company named in this Agreement;

“Client Personal Data” means personal data that the Client transfers to Allgo for the purposes of issuing Cards.

“Data Protection Legislation” means the EU General Data Protection Regulation and the Data Protection Act 2018.

“Effective Date” shall be deemed to be the date stated at the top of this Agreement;

“Force Majeure” means any occurrence or omission as a direct or indirect result of which the party relying on it is prevented from or delayed in performing any of its obligations under this Agreement and that is beyond the reasonable control of that party, including forces of nature, epidemics, pandemics, widespread infections, industrial action, labour disturbance, action or inaction by a government agency, an act of war (whether declared or not) or terrorism, the mobilisation of armed forces, civil commotion or riot, currency restriction or embargo, or a failure of a supplier, public utility or common carrier.

“Insolvency Event” means becoming insolvent or being in receivership, liquidation, provisional liquidation, administration or subject to an application for its winding up, a deed of company arrangement or scheme of arrangement for the benefit of its creditors or being otherwise unable to pay all debts as and when they fall due, or any analogous event.

“Material Breach” means:

- an event expressly identified as such in this Agreement;

- a substantial or significant failure by a party to perform material obligations under this Agreement, if that failure is so serious or ongoing that it

(i) causes significant legal, financial or reputational prejudice or risk to the other part

(ii) has a significant adverse effect on the ability of the other party to fulfil its obligations under this Agreement; or

(iii) amounts to the repudiation of this Agreement in law; - numerous or recurring failures by a party to perform its obligations under this Agreement, if those failures are so serious or are repeated with such regularity that they cumulatively:

(i) have significant legal, financial or reputational prejudice or risk to the other party;

(ii) have had a significant adverse effect on the ability of the other party to fulfil its obligations under this Agreement; or

(iii) amount to the repudiation of this Agreement in law.

“Services” means any and all services provided by Allgo to the Client in addition to the actual Gift Card, including card presentation, delivery and optional extras detailed in Schedule A – Physical Gift Card, Schedule B – Digital+ Gift Card, and Schedule C – Online Only Gift Card.

“Order” means any request for Gift Cards, including all the necessary details required to process the order, that is issued by the Client and accepted by Allgo;

“Order Spreadsheet” means the list of Card Recipients required for each order to allocate each Gift Card to a named recipient.

“Parties” means the Client and Allgo.

“Wilful Misconduct” means a party deliberately committing the relevant act or omission, knowing it to be a breach of the Agreement and knowing that it would cause a particular type of loss or damage that was in the party’s subjective contemplation prior to committing that act or omission.

2 RIGHTS AND DUTIES OF THE CLIENT

The Client shall:

2.1 be entitled to receive the Gift Cards and Services as specified in the Order.

2.2 provide all necessary employee data required by Allgo to process the Order.

2.3 inform Allgo promptly of any changes in its organisation or methods of doing business which might affect the performance of the Client’s duties under this Agreement.

2.4 acknowledge that it does not have the authority to enter into binding agreements of any nature on Allgo’s behalf.

2.5 pay Allgo the applicable charges under the applicable payment terms as detailed in Schedule A, prior to an Order being processed by Allgo.

2.6 Complete the client security (KYB) form at allgo.ie/allgo-mastercard-gift-card/client-security-form-kyb/) and provide any additional documentation required by Allgo and or the Card Issuer to approve the client as a purchaser of the Gift Card.

3 RIGHTS AND DUTIES OF ALLGO

Allgo shall:

3.1 provide the Gift Cards and Services as specified in the Order.

3.2 ensure that the Card Funds are segregated from any other funds of Allgo, the Card Issuer or other clients as described in Schedule D – Security of Funds.

3.3 provide reasonable notice in writing to the Client if any changes to Gift Card or Services prices are made by Allgo from what is detailed in Schedules A, B or C.

3.4 retain the right to refuse or deny any orders received from a Client at it sole discretion.

4 INTELLECTUAL PROPERTY

4.1 Allgo shall retain exclusive title over all intellectual property rights in the Gift Card and Services. No licence or other right is granted by Allgo except as expressly set out in this Agreement.

4.2 Nothing in this Agreement shall give the Client any rights in respect of any trade names or trademarks or other Intellectual Property Rights owned by Allgo, and used in provision of the Services.

5 CONFIDENTIALITY

5.1 The Parties will keep in confidence any information (whether written or oral) of a confidential nature (including software, manuals and website access) obtained under this Agreement and will not disclose that information to any person (other than employees of the Client or the Client’s professional advisors, or in the case of Allgo, its employees and professional advisors or the employees and professional advisors of any related or associated company) without the written consent of the other party. The Party receiving information is to be made aware of the confidential nature of the information.

5.2 Information generated or obtained in pursuance of this Agreement will not be used for any purpose other than under this Agreement.

5.3 Both parties shall at all times during the continuance of this Agreement and for two (2) years after its termination keep all Confidential Information confidential and not disclose any Confidential Information to any other person and not use any Confidential Information for any purpose other than the performance of its obligations under this Agreement.

5.4 Confidential Information may be disclosed to governmental or other competent authority or regulatory body upon request to such extent only as is necessary for the purposes provided in this Agreement or as required by law and subject in each case to the Party using its best endeavours to ensure that the person in question keeps such Confidential Information and does not use the same except for the purpose for which the disclosure is made.

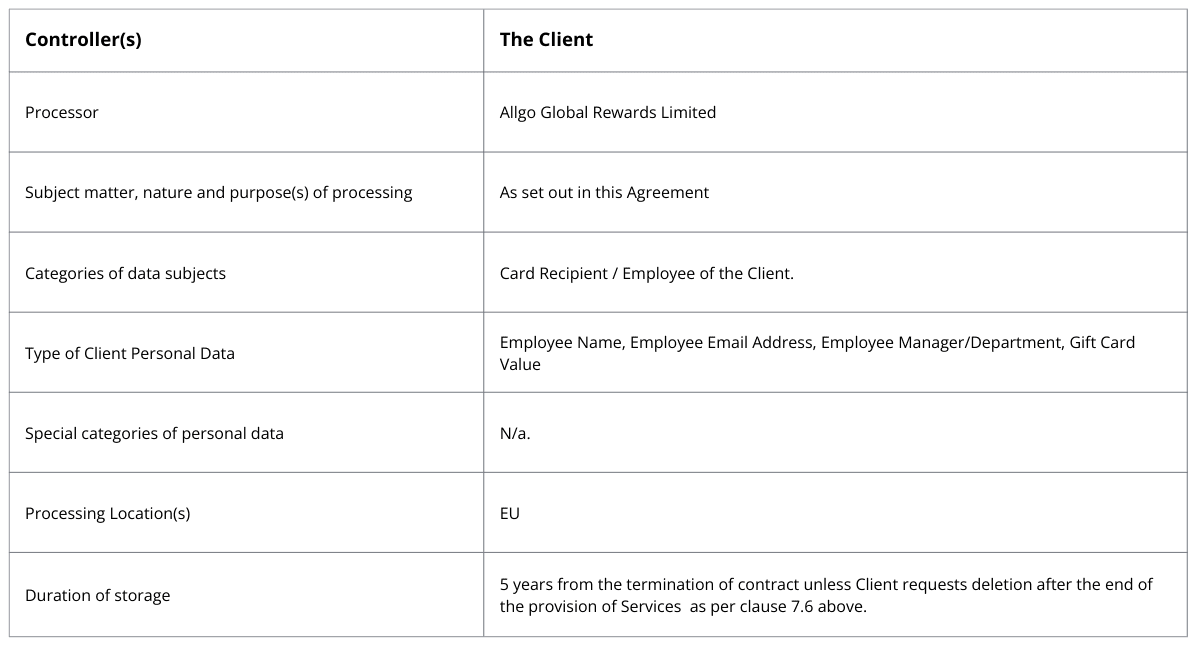

6 DATA PROTECTION

6.1 In this clause 7, the terms “personal data”, “personal data breach”, “process”, “data controller” and “data processor” shall have the meanings set out in the Data Protection Legislation (meaning all applicable laws and regulations relating to the processing of personal data and privacy of individuals in the relevant jurisdiction, as amended from time to time, including the General Data Protection Regulation (“GDPR”)).

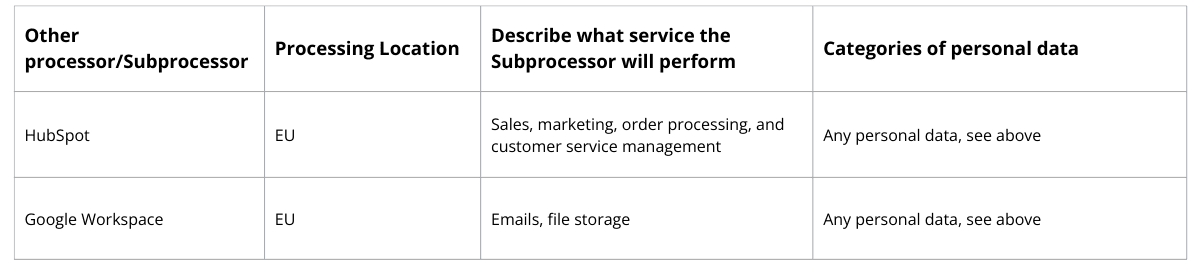

6.2 Allgo shall be acting as a data processor on the Client’s behalf in respect of any processing of Client Personal Data under this Agreement (employee details, etc.) for the purposes of issuing Cards and this clause 6 contains written data processing terms which meet the requirements of the Data Protection Legislation. Allgo transfers data to EML Money DAC for the purposes of issuing Cards, and they shall act as an independent data controller in respect of such data and with their own privacy controls and policies as detailed on https://www.emlpayments.com/privacy/.

6.3 Allgo acknowledges that it shall be acting as a data controller merely in respect of personal data that it requires to manage the business relationship with Client in connection with this Agreement (e.g. Client contact details, KYB details etc). Where acting as a data controller, Allgo shall comply with its obligations under the Data Protection Legislation in respect of personal data and process such data in accordance with its written Data Protection Policy and Data Protection Procedures. Without prejudice to the foregoing, Allgo shall not process Client personal data in a manner that will or is likely to result in Client breaching its obligations under the Data Protection Legislation.

6.4 Allgo shall only process Client Personal Data for the purposes of performing its obligations under this Agreement and for which it was disclosed by Client to Allgo.

6.5 Allgo shall not process (including by way of remote access) Client Personal Data outside (i) the European Economic Area (“EEA”), or (ii) countries (and where relevant sectors) at the relevant time are treated by the competent authorities within the EU as benefiting from an adequacy decision for the transfer of the relevant personal data without the prior written consent of Client.

6.6 Allgo shall delete all personal data within five years after termination of this Agreement. At the written request of the Client, Allgo shall delete or return all Client Personal Data to Client after the end of the provision of Services relating to processing, and delete existing copies unless EU or Member State law requires storage of Client Personal Data.

6.7 Where Allgo acts as a data processor, it shall

a) comply with Data Protection Legislation and clauses 7.4, 7.5 and 7.6;

b) process personal data only on documented instructions from Client, including with regard to transfers of personal data to a third country or an international organisation, unless required to do so by EU, Member State or other applicable law to which Allgo is subject; in such a case, Allgo shall inform Client of that legal requirement before processing, unless that law prohibits such information on important grounds of public interest;

c) ensure that persons authorised to process personal data have committed themselves to confidentiality or are under an appropriate statutory obligation of confidentiality;

d) take all measures required pursuant to Article 32 of GDPR and, in particular, implement appropriate technical and organisational measures to ensure a level of security appropriate to the risk presented by the processing, in particular, from accidental or unlawful destruction, loss, alteration, unauthorised disclosure of, or access to personal data;

e) respect the conditions referred to in paragraphs 2 and 4 in Article 28 of GDPR for engaging another processor; and Allgo shall inform Client of any intended changes concerning the addition or replacement of other processors, thereby giving Client the opportunity to object to such changes, and ensure the same (meaning equivalent) data protection obligations as set out in this Agreement shall be imposed on that other processor by way of a written agreement. Where that other processor fails to fulfil its data protection obligations, Allgo shall remain fully liable to Client for the performance of that other processor’s obligations;

f) taking into account the nature of the processing, assist Client by appropriate technical and organisational measures, insofar as this is possible, for the fulfilment of Client’s obligations to respond to requests for exercising the data subject’s rights laid down in Chapter III of GDPR (or in other applicable law);

g) assist Client in ensuring compliance with their obligations pursuant to applicable law, including Articles 32 to 36 of GDPR, taking into account the nature of processing and the information available to Allgo; and notify Client without undue delay and, in any event, within 48 hours of becoming aware of a personal data breach, provide Client with the information set out in Article 33(3) of GDPR and promptly take measures to address the personal data breach and mitigate its possible adverse effects;

h) make available to Client all information necessary to demonstrate compliance with Allgo’s obligations set out in this clause 7 and allow for and contribute to audits, including inspections, conducted by Client or another auditor mandated by Client; and

i) immediately inform Client if, in its opinion, an instruction infringes GDPR or other EU or Member State data protection provisions.

6.8 Processing details and purposes of processing:

7 FORCE MAJEURE

7.1 Neither party shall be deemed to be in breach of this Agreement, or otherwise be liable to the other, by reason of any delay in performance, or non-performance, of any of its obligations hereunder to the extent that such delay or non-performance is due to any force majeure of which it has notified the other party; and the time for performance of that obligation shall be extended accordingly.

7.2 If any delay or failure in performance of any part of this Agreement by a Party is attributable to an event of Force Majeure which continues for more than sixty (60) days then the other party shall be entitled to terminate the Agreement.

8 DURATION AND TERMINATION

8.1 This Agreement shall commence on the Effective Date and, save as otherwise terminated hereunder, shall continue in force for an initial period of 12 months (the “Initial Period”). Thereafter, this Agreement shall continue in full force and effect for subsequent periods of 3 months (each such period, a “Renewal Period”) on the then appliable terms of Allgo available at https://www.allgo.ie/allgo-mastercard-gift-card/tsandcs/. This Agreement may be terminated by either party after the Initial Period by either party giving to the other not less than one (1) months’ written notice prior to the end of the Initial Period or any Renewal Period.

8.2 Client shall be entitled to terminate this Agreement immediately by written notice to Allgo in circumstances where the Gift Card or Services can no longer be provided by Allgo or the Card Issuer due to a change of law, regulation or regulatory status, including in circumstances where (i) the Card Issuer ceases to be authorised in Ireland to issue electronic money or provide payment services with respect to Allgo Mastercard Gift Card; or (ii) Allgo ceases to be an agent of the Card Issuer.

8.3 A Party shall be entitled forthwith to terminate this Agreement immediately by written notice to the other Party if:

8.3.1 the other party breaches any Applicable Laws, unless said breach is capable of remedy. If the breach is capable of remedy, the non-breaching party may terminate this Agreement upon having served a written notice of the breach on the other party, and the other party having failed to remedy the breach within five (5) Business Days’ of service of that notice;

8.3.2 the other party commits a Material Breach. If the breach is capable of remedy, the non-breaching party may terminate this Agreement upon having served a written notice of the breach on the other party, and the other party having failed to remedy the breach within five (5) Business Days’ of service of that notice;

8.3.3 the other party breaches this Agreement by failing to make any payment required under this Agreement, unless the party which failed to make payment remedies the breach by making payment within five (5) Business Days’ of receipt of a notice to remedy;

8.3.4 the other party commits, or is the subject of, or threatens to commit an Insolvency Event;

8.3.5 the other party, its employees, agents or sub-contractors in performing obligations under this Agreement commits any fraudulent act or act of Wilful Misconduct; or

8.3.6 a Force Majeure Event continues for more than sixty (60) days.

9 CONSEQUENCES OF TERMINATION

9.1 Upon the termination of this Agreement for any reason whatsoever:

9.1.1 the Client shall cease to place any further Orders with Allgo;

9.1.2 the Client shall have no claim against Allgo for compensation for loss of goodwill, profit, earnings, or any similar loss relating to termination of this Agreement;

9.1.3 subject to the cancellations and returns section of Schedules A, B and C, or as otherwise provided herein and to any rights or obligations which have accrued prior to termination, Allgo shall have no further obligation to the Client under this Agreement; and

9.1.4 notwithstanding the termination of this Agreement, Cardholders will continue to be able to use their Gift Card(s) to make purchases and to avail of Cardholder customer support until their card(s) expire or their card balance(s) reduces to zero.

10 INDEMNITY

10.1 Each party (the “Indemnifying Party”) shall indemnify the other party against all costs, losses and damages which are incurred by the other party and any claims or legal proceedings which are brought or threatened against the other party by any other person to the extent that such costs, losses, damage, claims or proceedings arise as a result of any negligence or Wilful Misconduct on the part of the Indemnifying Party in the performance of this Agreement or breach of this Agreement or non-compliance with any statutes, laws, regulations or regulatory requirements.

10.2 The Indemnifying Party shall indemnify the other party against all costs, losses and damages caused by fraudulent use of the Client account through unsecure storage or sharing of account security details by the Indemnifying Party.

11 LIMITATION OF LIABILITY

Notwithstanding any other terms and conditions to the contrary, in no event shall Allgo, its officers, directors, affiliates or employees be liable for any form of indirect, special, consequential or punitive damages, whether such damages arise in contract or tort, irrespective of fault, negligence or strict liability or whether the seller has been advised in advance of the possibility of such damages. Liability for death or personal injury as a result of Allgo’s negligence is not excluded or limited by this provision.

12 TAXATION

12.1 The Parties acknowledge that Allgo has expressly advised the Client to seek independent tax advice as to any potential tax liabilities that may arise from the purchase and use of the Gift Card or Services.

12.2 The Client is solely responsible for any Revenue returns, and any Benefit-in-Kind, income tax, or any other tax liabilities that may arise from the purchase and use of the Gift Card or Services

13 NATURE OF AGREEMENT AND GENERAL PROVISIONS

13.1 Neither party may transfer any of their rights or obligations under this Agreement, without the prior written consent of the other party.

13.2 Allgo acknowledges and agrees that it is entering into this Agreement on behalf of itself and as agent for the Card Issuer in connection with the issue of the Allgo Mastercard Gift Card, which is an electronic money product.

13.3 Nothing in this Agreement shall constitute or be deemed to constitute a partnership or the relationship of employer and employee between the parties.

13.4 This Agreement contains the entire Agreement between the parties with respect to the subject matter hereof and supersedes all previous Agreements and understandings between the parties and may not be modified except in writing signed by the duly authorised representatives of the parties.

13.5 Allgo represents that (i) the Card Issuer is authorised in Ireland by the Central Bank of Ireland as an electronic money institution and is permitted to issue electronic money and provide payment services in Ireland in connection with the Allgo Mastercard Gift Card; and (ii) Allgo is permitted to distribute and redeem electronic money in Ireland as agent on behalf of the Card Issuer.

13.6 With the written approval of Client, Allgo may use Client’s name or logo for marketing purposes.

14 NOTICES

Any notice or other information required or authorised by this Agreement to be given by either party to the other may be given by hand or sent (by first class pre-paid post, facsimile transmission or e-mail) to the other party at the appropriate addresses.

For Allgo, all notices should be sent to-

Gary Purcell, Allgo Rewards, Digital Depot, The Digital Hub, Dublin 8, D08TCV4, Ireland. Email gary@allgo.ie

For the Client, all notices should be sent to the contact name and email specified in this Agreement, unless otherwise specified in writing by the Client.

15 GOVERNING LAW AND JURISDICTION

This Agreement shall be governed by and construed in accordance with Irish law and the parties submit to the jurisdiction of the Irish Courts in respect of any dispute or difference arising in relation to this Agreement.

16 WAIVER

Failure by either party to exercise or enforce any rights available to that party or the giving of any forbearance, delay or indulgence shall not be construed as a waiver of that party’s rights under this agreement.

17 INVALIDITY

If any term or provision of this agreement shall be held to be illegal or unenforceable in whole or in part under any enactment or rule of law such term or provision or part shall to that extent be deemed not to form part of this agreement but the enforceability of the remainder of this agreement shall not be affected.

SCHEDULE A – PHYSICAL GIFT CARD

Allgo Mastercard – Physical Gift Card

The physical card is a prepaid, single-load, magstripe physical Mastercard Gift Card can be spent instore by swiping through the card machine at checkout and signing the receipt – there is no PIN required.

This card can also be used online by first enrolling the card for 3D Secure. To do this, the cardholder enables 3D Secure via allgogiftcard.com by entering their mobile number, which is then used to confirm online purchases by SMS.

Ordering

Orders must be placed online at allgo.ie, and each order requires the Client to upload an Order Spreadsheet of Card Recipients in the required format (a spreadsheet template can be downloaded from the order page). Each card in the order is then allocated to a named recipient.

Delivery

Physical cards are bulk delivered by courier to your business location(s) for onward distribution to recipients. Cards can be grouped by manager/department. Cards can only be delivered to EU countries.

Activation

Before using the Card, each card recipient must register their card in an online account accessed via allgogiftcard.com AND must unlock their card by entering the same last name as contained in the Order Spreadsheet, plus an Activation Code that Allgo will provide to the Client.

Summary card activation instructions are printed on the card carrier wallet that each physical card is presented in.

For secure online spending, it is recommended that the cardholder enables 3D Secure via allgogiftcard.com by entering their mobile number, which is then used to confirm online purchases by SMS. Full card activation instructions are available on allgogiftcard.com

Pricing – Physical Gift Card

For basic and optional add-on pricing, please see the Allgo Mastercard Pricing page

Order Amendments – Physical Gift Card

Order details (eg names, card values, quantities, delivery address etc) can be amended by Clients prior to the order being processed by emailing corporateorders@allgo.ie. Amendments may cause delay to your order.

Once processed ready for dispatch, order details can be amended at a charge of €5 per card amended.

Order Cancellations – Physical Gift Card

If a Client, or Allgo, cancels an order after payment has been processed by the Client but before the order has been dispatched by Allgo, Allgo will arrange for full refund of the order payment within 30 days of cancellation to the same Client bank account or other payment method used for payment.

Returns – Physical Gift Card

In relation to any cards Clients would like to return (after payment has been processed by the Client and the order has been shipped by Allgo), Allgo will cancel unactivated and unused cards only within 6 months of issue, and either (at Client’s option):

- Return the funds to Client’s wallet as credit for future orders (incurring a fee of €10 per card) within 30 days of return.

or - Arrange for a refund to the same Client bank account or other payment method used for payment (incurring a fee of €20 per card) within 30 days of return.

If more than 6 months has elapsed after issue, no returns are permitted.

The above prices are valid as at 06.11.2023 and subject to change as per Clause 3 of this Agreement.

SCHEDULE B – DIGITAL+ GIFT CARD

Allgo Mastercard – Digital+ Gift Card

The Digital+ card is a prepaid, single-load, emailable Mastercard Gift Card can be spent online or instore by the Cardholder adding the card to Google Pay / Apple Pay and then “paying by tapping” their mobile phone.

Ordering

Orders must be placed online at allgo.ie, and each order requires the Client to upload an Order Spreadsheet of Card Recipients in the required format (a spreadsheet template can be downloaded from the order page). Each card in the order is then allocated to a named recipient.

Delivery

Digital+ Cards are emailed directly to the individual end recipients. Digital+ Cards can can only be emailed to recipients in EU countries.

Activation

Recipients redeem and activate their Digital+ cards by downloading the Get My eCard App from Google Play or Apple App Store.

For secure online spending, it is recommended that the cardholder enables 3D Secure via allgogiftcard.com by entering their mobile number, which is then used to confirm online purchases by SMS. Full card activation instructions are available on allgogiftcard.com

Pricing – Digital+ Gift Card

For basic and optional add-on pricing, please see the Allgo Mastercard Pricing page

Order Amendments – Digital+ Cards

Order details (eg names, card values, quantities, delivery address etc) can be amended by Clients prior to the order being processed by emailing corporateorders@allgo.ie. Amendments may cause delay to your order.

Once processed ready for dispatch, order details can be amended at a charge of €5 per card amended.

Order Cancellations – Digital+ Cards

If a Client, or Allgo, cancels an order after payment has been processed by the Client but before the order has been dispatched by Allgo, Allgo will arrange for full refund of the order payment within 30 days of cancellation to the same Client bank account or other payment method used for payment.

Returns – Digital+ Cards

In relation to any cards Clients would like to return (after payment has been processed by the Client and the order has been shipped by Allgo), Allgo will cancel unactivated and unused cards only within 6 months of issue, and either (at Client’s option):

- Return the funds to Client’s wallet as credit for future orders (incurring a fee of €10 per card) within 30 days of return.

or - Arrange for a refund to the same Client bank account or other payment method used for payment (incurring a fee of €20 per card) within 30 days of return.

If more than 6 months has elapsed after issue, no returns are permitted.

The above prices are valid as at 06.11.2023 and subject to change as per Clause 3 of this Agreement.

SCHEDULE C – ONLINE ONLY GIFT CARD

Allgo Mastercard – Online Only Gift Card

The Online Only card is a prepaid, single-load, emailable Mastercard Gift Card can be spent online only.

Ordering

Orders must be placed online at allgo.ie, and each order requires the Client to upload an Order Spreadsheet of Card Recipients in the required format (a spreadsheet template can be downloaded from the order page). Each card in the order is then allocated to a named recipient.

Delivery

Online Only cards are emailed directly to the individual end recipients. Online Only cards can can only be emailed to recipients in EU countries.

Activation

Before using the Online Only card, each recipient must register their card in an online account accessed via allgogiftcard.com AND must unlock their card by entering the same last name as contained in the Order Spreadsheet, plus an Activation Code that Allgo will provide to the Client.

For secure online spending, it is recommended that the cardholder enables 3D Secure via allgogiftcard.com by entering their mobile number, which is then used to confirm online purchases by SMS. Full card activation instructions are available on allgogiftcard.com

Pricing – Online Only Gift Card

For basic and optional add-on pricing, please see the Allgo Mastercard Pricing page

Order Amendments – Online Only Gift Card

Orders (eg names, card values, quantities, delivery address etc) can be amended by Clients prior to the order being processed by emailing corporateorders@allgo.ie. Amendments may cause delay to your order.

Once processed ready for dispatch, order details can be amended at a charge of €5 per card amended.

Order Cancellations – Online Only Gift Card

If a Client, or Allgo, cancels an order after payment has been processed by the Client but before the order has been dispatched by Allgo, Allgo will arrange for full refund of the order payment within 30 days of cancellation to the same Client bank account or other payment method used for payment.

Returns – Online Only Gift Card

In relation to any cards Clients would like to return (after payment has been processed by the Client and the order has been shipped by Allgo), Allgo will cancel unactivated and unused cards only within 6 months of issue, and either (at Client’s option):

- Return the funds to Client’s wallet as credit for future orders (incurring a fee of €10 per card) within 30 days of return.

or - Arrange for a refund to the same Client bank account or other payment method used for payment (incurring a fee of €20 per card) within 30 days of return.

If more than 6 months has elapsed after issue, no returns are permitted.

The above prices are valid as at 06.11.2023 and subject to change as per Clause 3 of this Agreement.

SCHEDULE D: SECURITY OF FUNDS

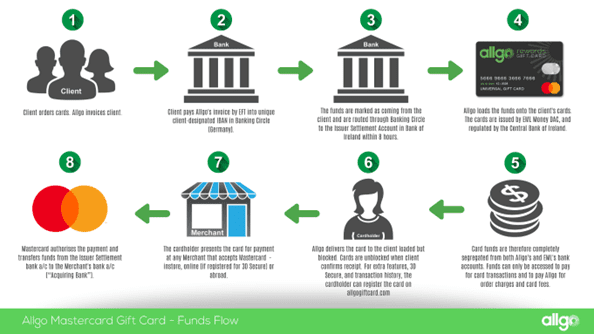

The Allgo Mastercard is an e-money product, and is regulated by the Central Bank of Ireland. The card is issued under licence from EML Money DAC, a fully licenced e-money operator.

Security of funds on Allgo Mastercard Gift Cards is ensured through the use of a segregated card settlement bank account. Once loaded, card funds are held in a segregated settlement account in Bank of Ireland. Funds in this account can only be accessed to pay for card transactions and to pay Allgo for order charges and card fees

Card funds are therefore completely segregated from both Allgo’s and EML’s bank accounts.

SCHEDULE E: CARDHOLDER TERMS & CONDITIONS

Terms and Conditions for using the Allgo Mastercard gift Card, including all potential cardholder charges, are published on the dedicated cardholder website allgogiftcard.com. See https://www.allgogiftcard.com/tsandcs