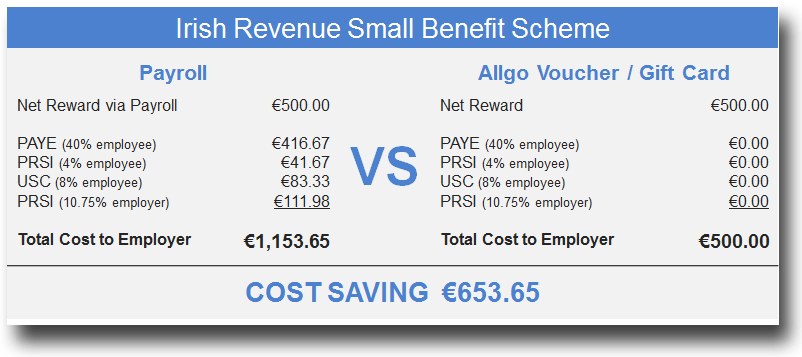

Under Irish Revenue’s Small Benefits Exemption Scheme, employers can now reward employees with a non-cash bonus of up to €500 in value completely tax free each year. Provided certain guidelines are followed neither the company nor the employee will pay PAYE, PRSI or USI, potentially saving €653.65 in tax.

To qualify for the tax exemption, only one tax-free bonus may be paid to each employee in any one year. If more than one bonus is given in a year, it is only the first one that will qualify for tax-free status, even if this bonus is less than the €500 annual allowance – any used allowance cannot be carried over. The tax-free bonus must be paid in non-cash form.

There is no paperwork and no return to be made to avail of the scheme. Companies (or sole traders) are simply invoiced for the total value of tax-free vouchers ordered. The invoice is treated as a normal business expenses for accountancy purposes, and there is no need to adjust payroll in any way – provided the above rules are followed. Business owners and director can also benefit from the scheme.

AllGifts Vouchers and the Allgo Rewards Gift Card are fully compliant with the Small Benefits Exemption Scheme. If you wish to spread out the benefit over the year, Allgo’s points incentive programme can be used to provide ongoing points, which at year end can be redeemed for a one-off bonus to comply with the tax-free scheme.